A fundamental question we hear more than ever

On a recent call with one of our long-time clients, their finance lead paused and asked a simple, yet loaded question:

“We’re a small business. Is cyber insurance really necessary?”

It’s a fair question. A question that ultimately revolves around cash-flow volatility. Liquidity. Operational continuity.

And it’s become the starting point for almost every conversation we have with SMBs today.

The financial reality: Cyber incidents are now a predictable cost of doing business

Some Canadian SMB owners believe cyber incidents are catastrophic “one-in-a-million” events. In reality, incidents are frequent, financially disruptive, and increasingly tied to email fraud, credential attacks, and supply-chain compromise. In other words, they’re not always the attacks that make headlines.

Here’s what the latest national data shows in Canada¹:

- About 1 in 6 (16%) Canadian businesses reported being impacted by a cybersecurity incident in 2023, with identity theft, scams/fraud, and ransomware among the most common attack methods.

- Total spending on recovery from cybersecurity incidents in 2023 (the latest reported year) doubled from about $600 million in 2021 to about $1.2 billion, signaling both the frequency and magnitude of incidents.

- Only about 22% of Canadian businesses reported having cyber risk insurance in 2023, despite rising incident and recovery costs.

When you combine realistic incident probabilities with the kinds of losses Canadian surveys and claims data report (often 100K or more for material incidents), the expected annual financial exposure for many SMBs can easily exceed insurance costs several times over.

Controls reduce the likelihood. Insurance reduces $ impact.

Modern security controls dramatically reduce the likelihood and severity of incidents. But they cannot eliminate:

- Business email compromise

- Vendor or supplier impersonation

- Payroll rerouting scams

- Credential-based attacks

- Small-scale ransomware on a single device

These are the claims insurers see most often.

And they are precisely the scenarios where a sudden cash crunch, not technical downtime, harms SMBs the most.

Cyber insurance exists to absorb that shock.

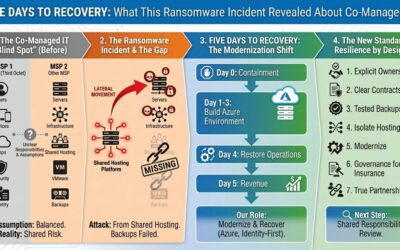

Wondering what a successful cyber insurance claim actually looks like? Before you scroll any further, read this real-world ransomware recovery that shows exactly why MFA, verified backups, and clear ownership matter.

Why SMBs increasingly struggle with cyber insurance (and why IT governance matters)

Five years ago, most SMBs could obtain cyber insurance with a signature and a cheque. Today, insurers expect clear, verifiable evidence of:

- MFA across all critical systems

- Endpoint detection and response

- Secure, immutable backups

- Patch automation

- Privileged-access governance

- Documented incident response processes

This shift isn’t “compliance theatre.”

It’s how insurers determine whether a business is insurable (and whether a claim will be paid).

Where many SMBs encounter friction isn’t in the technology itself.

It’s in the documentation:

- Missing or outdated control evidence

- Incomplete logs

- No written response plan

- Unverified backup integrity

- Gaps between stated practices and actual practices

These control and documentation gaps are now among the most common reasons cyber insurance claims are delayed, reduced, or denied. A good IT provider doesn’t just deploy security controls; it maintains the verifiable proof insurers require.

A simple example: A typical SMB’s financial exposure

Consider a 25–40 person professional services firm:

- Annual incident probability (conservative SMB estimate): ~20–30%

- Modelled loss range for illustration: $25K–$120K

- Typical annual premium: ~$3K–$4K

Expected annual loss model

Using the conservative end of the modelled range:

- 0.25 × $25K = $6.25K expected annual loss

- $6.25K ÷ $4K ≈ 1.56× financial justification

(At the median or high end, the gap widens significantly).

Cyber insurance is not replacing good security; it is financing the residual risk every SMB carries by default.

Why strong IT governance supports successful payouts

This is the part that often surprises SMBs.

Insurers don’t just evaluate risk during underwriting; they re-evaluate it when you file a claim. That means:

- If MFA isn’t enforced everywhere

- If backups weren’t truly immutable or tested

- If endpoint logs are incomplete

- If privileged accounts aren’t governed

- If risk documentation is missing or outdated

…then even a legitimate claim can be delayed or denied.

Strong IT governance reduces uncertainty by keeping control evidence accurate, consistent, and ready for insurers when it matters.

So, is cyber insurance “required”?

For most Canadian SMBs, yes. Not because it’s fashionable, but because:

- Incidents now routinely exceed typical cash reserves

- Insurers expect controls that most SMBs cannot maintain alone

- Contractual and vendor requirements increasingly assume coverage

- The uninsured costs (forensics, legal, recovery, business interruption) have spiked

- Cyber insurance has become a financial continuity tool, not a technical add-on

You don’t buy cyber insurance to prevent incidents.

You buy it because when they happen, they shouldn’t threaten your business’s stability.

Want to see your actual numbers?

In about 30 minutes, we can model your:

- 5-year expected cyber loss

- Likely premium range

- Insurability score based on current controls

- Documentation gaps that matter to underwriters

- One-page cash-flow impact summary

If you want clarity on your actual numbers: expected losses, premium range, and what insurers look for, contact us today.

Want proof instead of promises? Here’s an actual ransomware incident where clear ownership, tested systems, and cyber insurance coverage worked together exactly as intended to bring a Canadian small business back online and operational in five days.

Source

FAQs

What does cyber insurance typically cover for SMBs?

Most Canadian SMB policies cover:

- Incident response and forensic investigation

- Data recovery and system restoration

- Business interruption losses

- Legal and regulatory costs

- Customer notification and PR

- Funds-transfer fraud

- Ransomware response

Coverage varies widely, which is why underwriting documentation (and accurate control evidence) matters.

What controls do insurers actually require, and why?

While every insurer differs, most expect:

- MFA across critical systems

- Modern endpoint detection and response (EDR)

- Immutable, tested backups

- Email protection and phishing controls

- Patch automation

- Privileged-access governance

- Documented response processes and logs

0 Comments